In 2024, Japan Remains a Great Destination for Orphan Drug Companies

Our APAC experts explore Japan's evolving landscape for orphan drug companies in 2024.

Nearly a decade ago, I penned an article for Life Science Leader titled “Investigating the Myths About Opening a Subsidiary in Japan.” In that piece, I dissected the genuine and perceived obstacles for entry at the time, offering a comprehensive view of the drug approval process, regulatory landscape, market access and pricing, costs and the availability of local leadership and talent in Japan. All indicators pointed to Japan as an environment where many emerging orphan drug companies could seriously consider establishing their own subsidiaries, despite the market being often misunderstood.

Since the publication of that article in 2015, a surge of companies has indeed set up operations in Japan, ranging from larger entities like Regeneron to more specialized ultra-rare and gene therapy companies such as KalVista, Krystal Bio, Ultragenyx and BioCryst. The success of their ventures and the appropriateness of their decision to enter the market remains for their leadership to assess, but the majority of these companies are still active in Japan. Instances where companies have exited the market are typically attributable to mergers and acquisitions, like AveXis and Horizon, or shifts in global strategic direction, as seen with Sarepta.

Filling the Gaps in Japan’s Drug Landscape

Over the past nine years, I have had the privilege of supporting several companies in entering and expanding within the Japanese market by assisting them in assembling local leadership teams. During this time, the Japanese government has made concerted efforts to dismantle barriers to entry and actively attract companies to Japan. Recent years have seen an acceleration of this effort, with a particular emphasis on addressing the issue of "drug loss."

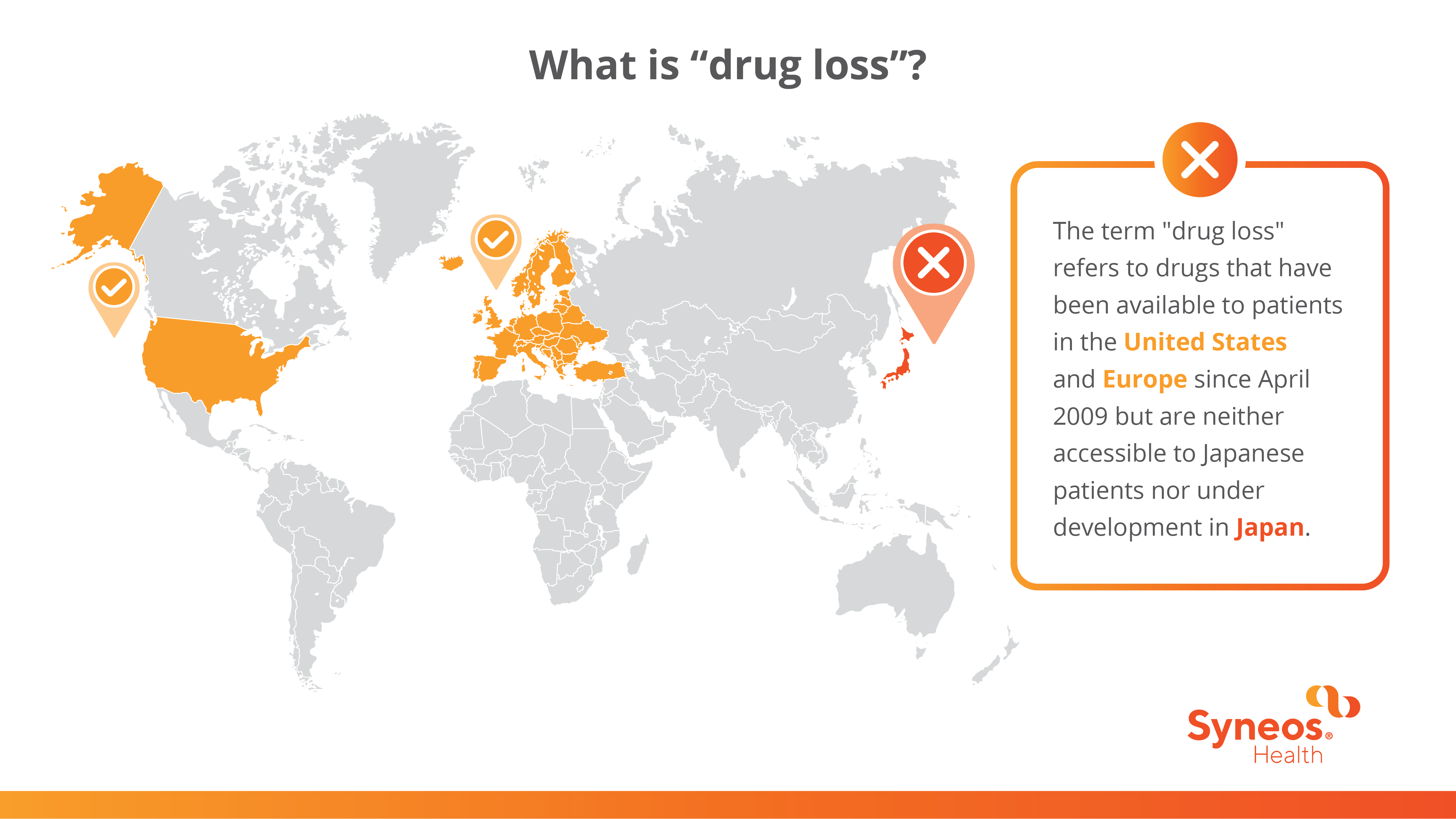

The term "drug loss" refers to drugs that have been available to patients in the US and Europe since April 2009 but are neither accessible to Japanese patients nor under development in Japan. To address this disparity, the Pharmaceutical and Medical Device Agency (PMDA) maintains databases for those drugs. Since 2023, Japanese authorities have initiated extensive initiatives to bridge these gaps.

Reimagining Japan’s Role in Global Clinical Trials

A significant development in this regard is the latest guidance from the Japanese Ministry of Health, Labor, and Welfare regarding the "basic principles for conducting phase 1 studies in Japanese prior to initiating multi-regional clinical trials, including Japan, for drugs in which early clinical development is preceding outside Japan." Released in December 2023, this document signifies a monumental shift in policy.

The guidance states that, generally, it is not obligatory to conduct phase 1 studies in Japan before initiating multi-regional clinical trials (MRCTs). Instead, an additional phase 1 study in Japanese is only warranted if deemed necessary after evaluating the safety and tolerability of the dosage in Japanese participants based on available data. This groundbreaking change suggests that, in many cases, Japan will be on par with other major global markets, potentially signaling the end of Japan's reputation as a challenging and costly market. While the implications of this guidance extend beyond phase 1 studies, it marks a significant stride toward Japan's integration into the global pharmaceutical landscape, potentially leveling the playing field with other major markets.

Japanese Regulators Foster Collaboration

Additionally, reports indicate that the PMDA intends to establish an office in Washington DC, near the FDA, to foster closer ties and information exchange between regulatory bodies. This initiative aims to assist emerging US companies in navigating the regulatory process and entering the Japanese market.

This move underscores the Japanese government's desire to attract more foreign companies to provide therapies to Japanese patients. While not every company may opt for a Japanese subsidiary, many will find the flexibility of the Japanese authorities appealing, thereby fostering a diverse ecosystem of overseas companies introducing groundbreaking technologies to Japanese patients—a development that bodes well for the life sciences industry.

Are you looking to grow your biopharma asset portfolio with an entry into Japan or the APAC region? Contact us to explore options with our regional experts.