Pharma has woken up to label optimization. Figuring out, in advance of your pivotal trial, what robust and compelling language you need in your label has become one of the most strategic issues in drug development.

Early Thinking Pays Off In Powerful Launch Labels

The first thing everyone wants to know about a new drug is, “how is it better?” The way the answer is worded in TV commercials, online promotion, and physician sales materials can be worth billions of dollars to a pharma manufacturer. And it all depends on what the FDA or the EMA allows in the label.

Yet, until recently, label language was not only one of the last documents submitted before approval but also among the last things on new-product planning team minds during early clinical trials. However, that is changing. Pharma has woken up to label optimization. Figuring out, in advance of your pivotal trial, what robust and compelling language you need in your label has become one of the most strategic issues in drug development.

For an early example, Eli Lilly’s TV commercials for Cialis said outright that the product is “ready when you are” for men with erectile dysfunction. (Competitor Viagra’s window of efficacy is just 4 hours). Observers familiar with development of Cialis say that as soon as Phase II studies showed a 17-hour half-life, the team began strategizing how to get competitive language about it into the label. “Improves erectile function compared to placebo up to 36 hours post-dose” became a key part of the Dosage and Administration section, helping propel Cialis to blockbuster sales. And even as the company was launching the product for PRN use, it was conducting studies to get a lower-dose, daily-use version approved, anticipating a whole new market.

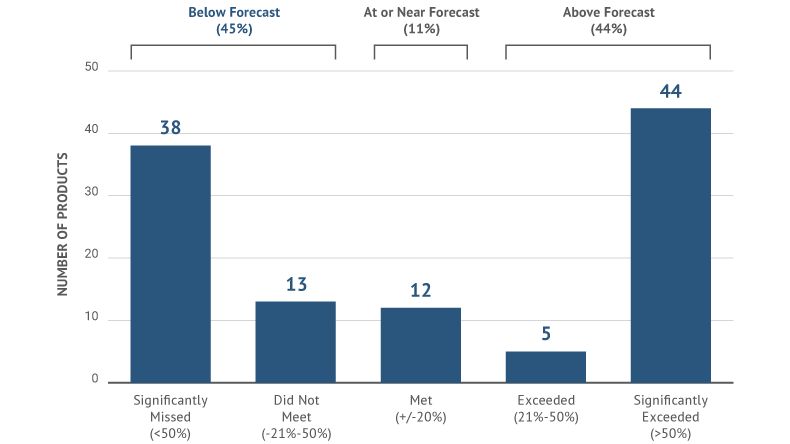

Competitive masterstrokes like these happen less often than one might imagine. Many drugs launch with labels practically indistinguishable from those of competitors already on the market. Some spend millions reaching endpoints that lack resonance or urgency with audiences. Recent Syneos Health research shows that nearly two-thirds of all drug launches miss the expectations of their sponsors and industry analysts. A key reason according to the study: lack of meaningful data to build compelling label claims.

Blockbuster Label Or Lackluster Label? Pre-Planning Makes The Difference

A set of best practices has emerged starting at Phase II, or even earlier for orphan diseases and oncology drugs. Some call this process label optimization; our proprietary process for it is called Winning Label. Name it what you like, these steps bring strategic discipline and collaboration to the task of optimizing clinical trial design for competition, beyond simply getting to market faster.

Step 1: Convene a multidisciplinary team

A cross-functional team is a must. Commercial stakeholders such as portfolio managers, market analytics experts, brand managers, new product planning teams and market access strategists keep close watch on market trends. They can share with R&D not only what features prescribers desire, but also language they use to describe these needs, language that ideally enters the label.

Step 2: Define the launch environment

Intelligence-gathering should be future-oriented. In our process, for example, we define the upcoming launch environment: how stakeholder expectations will evolve, new market entrants, genericization and changes in clinical, access and reimbursement guidelines. We look at how the FDA and the EMA accept new biomarkers and other efficacy/safety metrics. The goal: to identify label claims that will win this drug a compelling value proposition in the years following its launch half a decade from now.

We scrutinize word and phrase choices within all current competitive labels, section by section, which require analysts to have cross-functional experience within the desired indication and its market. For example, we seek signs that regulators may have reined in claims for lack of sufficient data – potential opportunities for you. Similarly, we look for exceptions both good and bad – clues to what your product is up against and what gaps you may be able to fill. In many ways it is more art than science.

We also review clinical trial designs for pipeline competitors. What outcomes are they measuring? What assumptions are they challenging?

A deep understanding of audiences and their unmet needs drives this quest for unexpected, uncontested, or superlative label language that can prevail in current and future markets. As an example, for years marketers of hormonal birth control assumed a period-like monthly discharge was mandatory... until they listened to patients who clamored for freedom from the need for tampons, pads and PMS. An entire new category of "pills" and label claims emerged in Seasonale, Lybrel, and others.

Step 3: Think about the supportive data required

Imagine your drug being advertised to consumers on TV. What language would move them? What would they be indifferent to? Then ask how you will prove it. The road to launch is littered with skeletons of claims that never made it to the label for lack of sufficient evidentiary support.

Some factors we consider are:

- What primary endpoint addresses the desired claim in a clinically meaningful way? Is it a well-established endpoint? Are secondary endpoints such as patient-reported outcomes (PROs) needed to differentiate the product commercially? What is needed to prove controversial claims such as less abuse potential, efficacy in obesity, or improved compliance? Consider factors such as patient preferences for dosing regimen, or tablet size, or particularly unwelcome adverse events that PROs could document.

- What are our pivotal trial design options, especially regarding comparators? Out-performing a weak comparator will not be impressive if the market has already moved away from using it.

- Will use of novel emerging clinical trials designs (such as adaptive and basket trials) cause confusion to physicians and their patients?

- How would we quantify opportunities like the clinical impact of un-addressed administration, storage, and other management hurdles we can solve through form factors, packaging, or kinetics?

- What must be shown to claim an earlier place in a treatment sequence? In combination with other drugs, or as monotherapy?

- In our current environment, where patient convenience or tolerability do not always factor into reimbursement decisions, is there a safety signal that we could turn to potential advantage? Should our trials be designed a priori to compare a specific unwanted event and potentially claim superiority over a competitor, rather than rely on a posteriori comparisons that provide less compelling proof?

- How will the clinical trial patient population affect commercial use? Will inclusion or exclusion criteria expand or limit broader utilization in the elderly and/or children? Conversely, can we “own” an unmet need characterized by an underserved subpopulation of patients – for example, treatment-naive (or on concomitant therapy), or genetically distinct patient groups.

The team must let unmet needs, data and economics drive decisions about what can and cannot be included in the clinical trial program. We model the potential market value of possible claims, running alternative scenarios. We also examine how claims should roll out over the product’s life cycle. Some may be desirable, but not critical for launch – and could be deferred.

We look as well at practicalities. The more outcomes studied, the longer and more costly the clinical development program. Add in regulatory negotiation time if you use new biomarkers, endpoints, or non-standard metrics, and budgets and timelines maybe upended.

Prioritization is the key to finding the right balance and staying on track.

- What will each change in trial design and capture of additional data (e.g., resources, patient recruitment, timeline, reporting) cost?

- What risks accompany each trial design?

- What is each label expansion worth to us in incremental sales?

- How much can we spend?

Clinical colleagues can offer valuable counsel early on, while the team evaluates options and before it issues bid requests. They can suggest less costly approaches, advise on recruitment, and show how to capture data points that might be overlooked. For example, if shorter time to onset of effect is a potential claim, these experts can advise on how costly capturing data more frequently and/or increasing statistical power through large sample sizes would be.

Step 4: Align on the optimal critical path and execute

With answers in hand, the team can develop or revise a Target Product Profile (TPP) informed by market insights, organization strategy, and clinical feasibility. As the FDA puts it, “the ideal version of what the sponsor would like to claim in labeling [emphasis in original] guides the design, conduct, and analysis of clinical trials to maximize the efficiency of the development program.”[1] Alignment within the team and top management buy-in to the TPP are essential, as changes beyond this stage can incur large costs and time delays. Yet flexibility is key, too: as important data emerge from trials or market conditions change, the team must re-examine the TPP and, if appropriate, change it accordingly.

Benefits Of Using This Process

A label optimization process such as Winning Label can deliver a strong return on investment for any drug, but it is particularly valuable for products entering rapidly-changing fields like oncology, in areas where real-world evidence is gaining acceptance, and for small/midsize companies with limited experience commercializing new drugs. Does your process include these best practices? The answer could have profound consequences for your product’s bottom line.

For more information, contact:

Wendy Balter, President, Cadent Medical Communications, a Syneos Health company [email protected]

Kathryn Bohannon, Senior Vice President, General Medicine, Syneos Health [email protected]

Jessica Lee, Director, Commercial Strategy & Planning, Syneos Health Consulting [email protected]

Rohit Sood, Practice Area Leader, Commercial Strategy & Planning Practice, Syneos Health Consulting [email protected]

[1] U.S. Department of Health and Human Services, Food and Drug Administration

Center for Drug Evaluation and Research (CDER). Guidance for Industry and Review Staff: Target Product Profile — A Strategic Development Process Tool.

March 2007. www.fda.gov/downloads/drugs/guidancecomplianceregulatoryinformation/guidances/ucm080593.pdf Accessed 8/13/2018.

Check out the article on Pharma intelligence.